How does your behavior affect your investment decisions?

Success in investing is about more than investment selection or diversification. Oftentimes, the biggest factor in determining investor success is managing biases and behaviors. History shows us that reactive investors – those that pull out during downturns and get greedy when the market swells – often show fewer long-term results than investors who follow a steady plan.

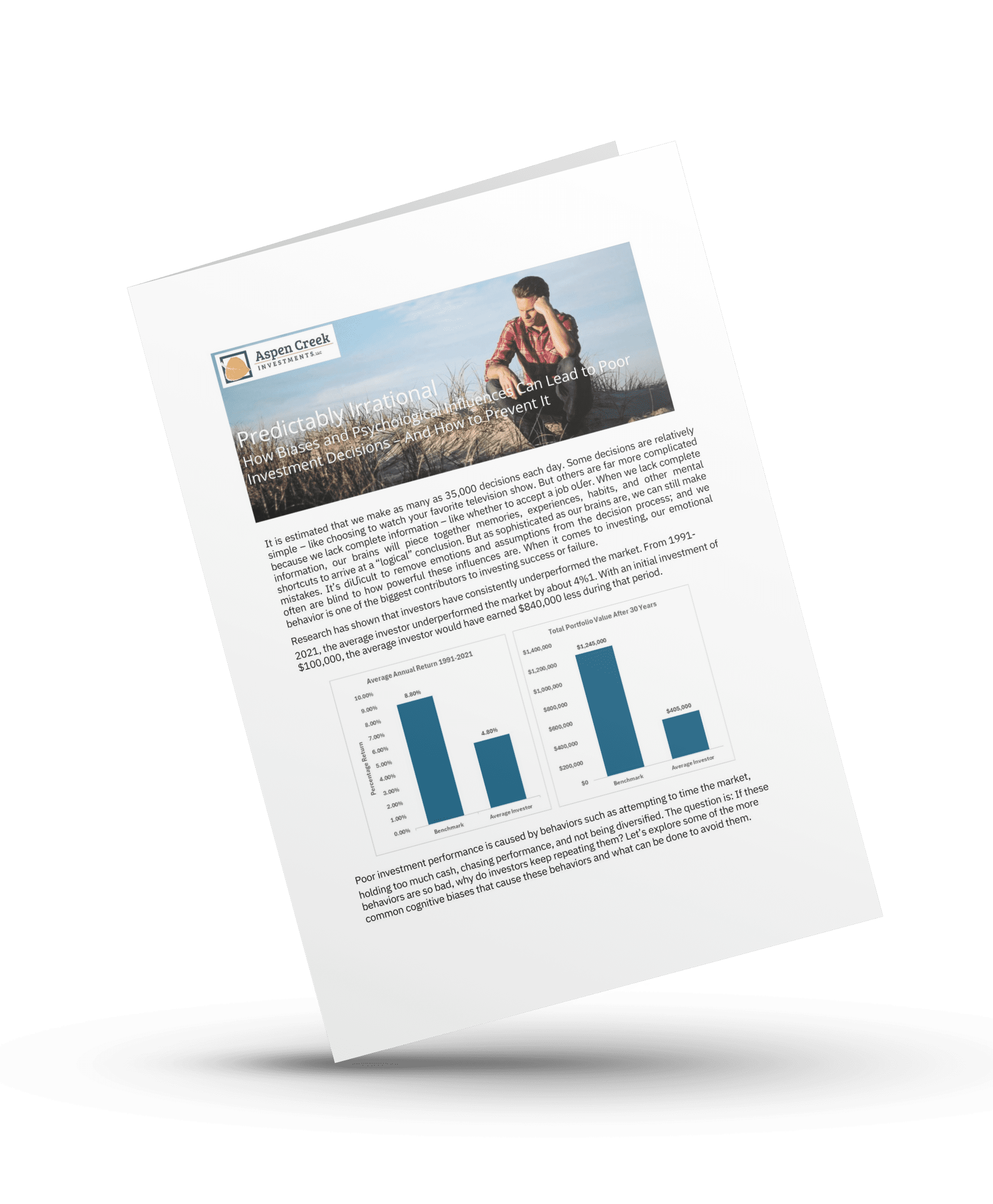

Our new whitepaper – Predictably Irrational – discusses some of the most common cognitive biases that can affect investor decisions. If you download this free resource, you’ll get actionable tips to help you better understand your behavior and potentially lead you to greater investment success.

To download your free whitepaper, complete the form below: